The Silent Force changing your competitive landscape.

In numerous meetings I had in 2023 with Owner/CEOs of Privately held companies, I heard “I’m not sure what recession the media is talking about, I’re very busy and growing…” I point this out in response that post-recession, our economy is largely driven by privately held businesses (versus publicly traded ones) and because they are ‘private’ the information is harder to acquire… so it’s much harder for even an unbiased media to capture and report what is truly happening.

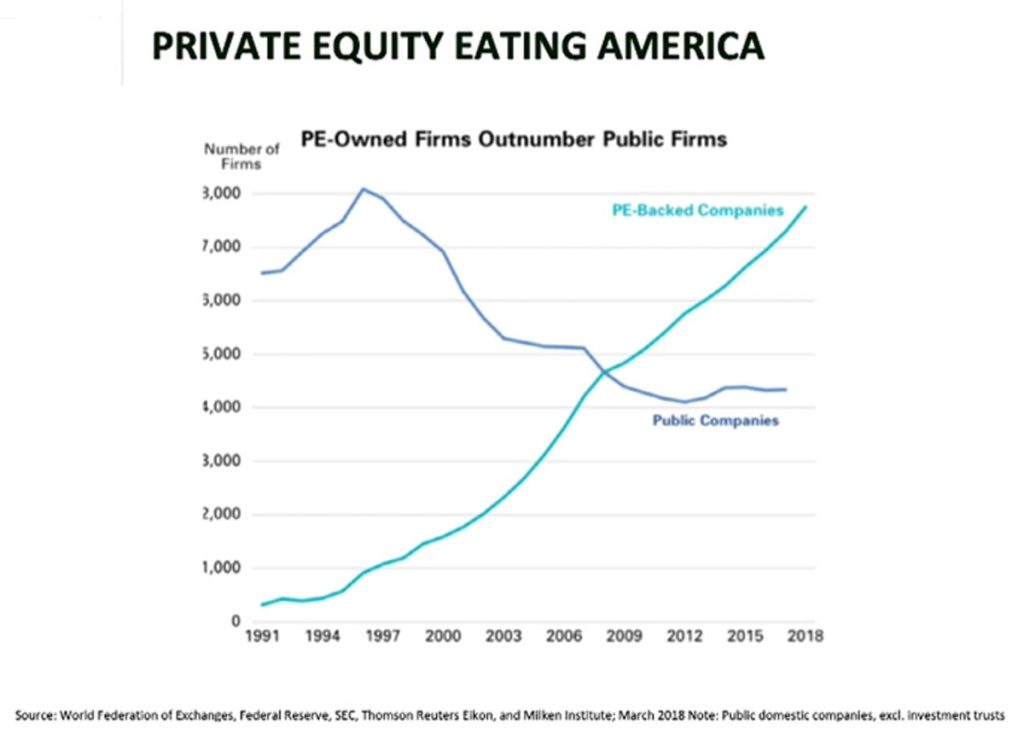

Perhaps the most important fact that you’re not hearing from the news media? There are now more US Private companies owned by Private Capital investors than there are publicly traded companies. (‘Private Capital Investors’ includes traditional Private Equity funds, Family Office investors and Independent Sponsors).

You may be familiar with the writings of Gazelles CEO Verne Harnish, who offers advice on common challenges facing growth companies in four key areas: People, Strategy, Execution, and Cash. As a business owner, this likely resonates with you. While his tenants Ire developed pre-recession, I would suggest that in 2020 and beyond “cash” should be updated to “capital”. The capital landscape is changing in your industry, driving changes to the competitive landscape which are about to accelerate in the next three to five years. Here’s why:

The public markets have changed:

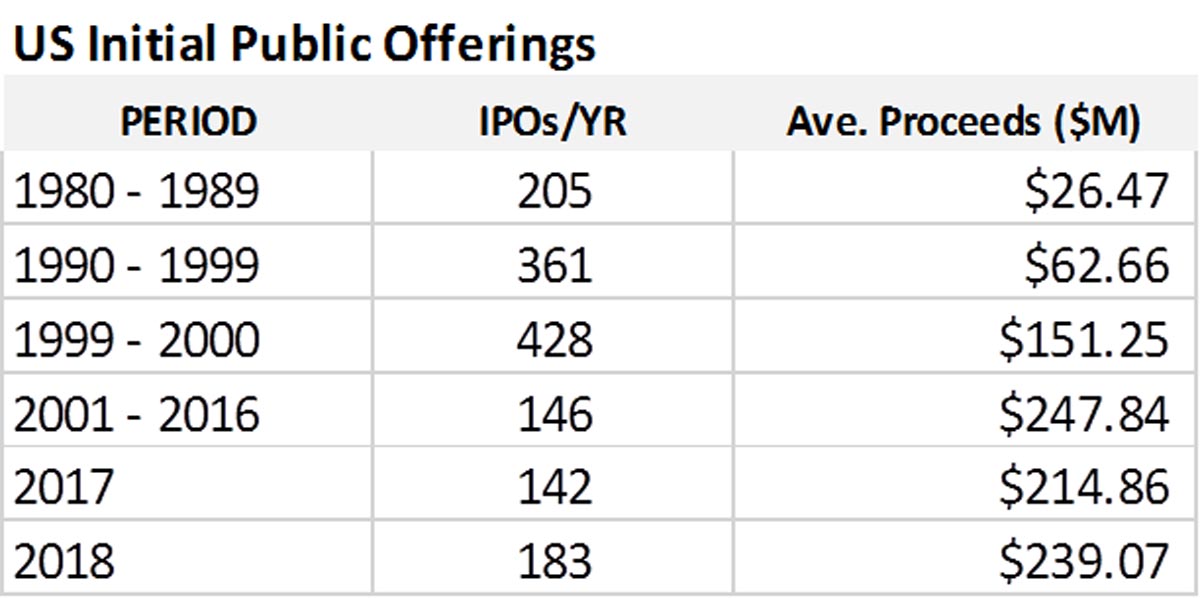

In the 80’s and 90’s, many private business owners exited their companies by going public. Here’s a recent historical summary of public markets:

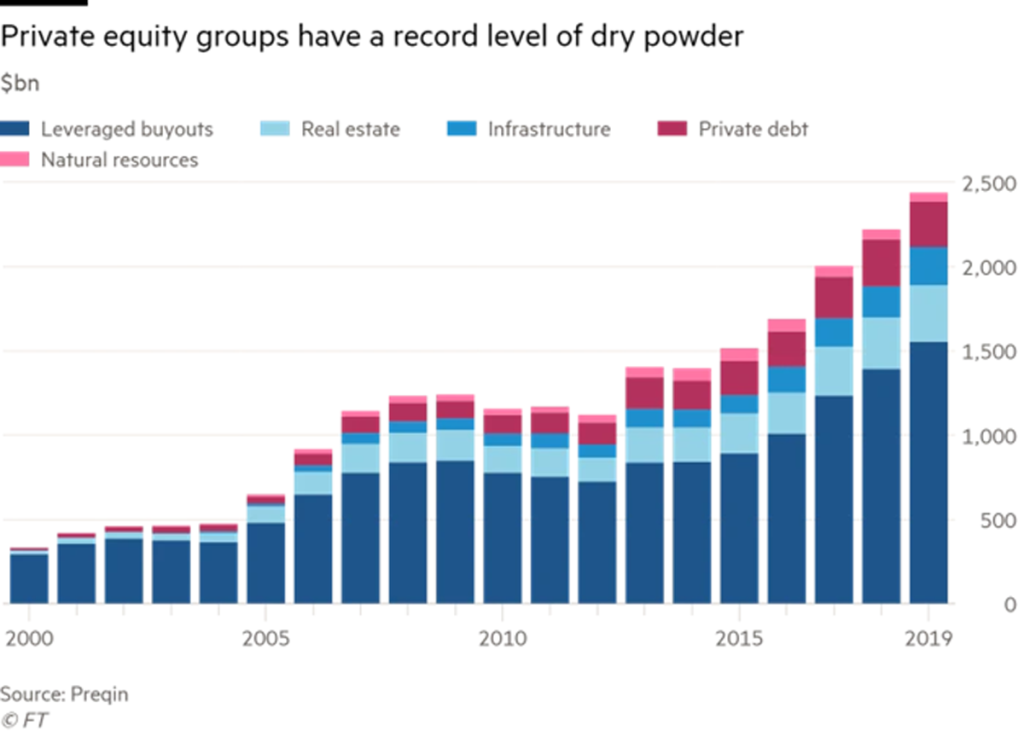

Silently (to mainstream media), the Private Markets have changed too: In the years following the dot-com bubble and recession, the amount of capital flowing into Private Equity has exploded. Why? Capitalism 101 – returns in Private Equity have outperformed the public markets. The below chart shows the growth in PE “dry powder” (committed capital waiting to be deployed):

Thirty years into this trend, we’re seeing the seeing the results take hold, and in 2019 there are now more US Companies owned by Private Capital than there are businesses trading on the public markets.

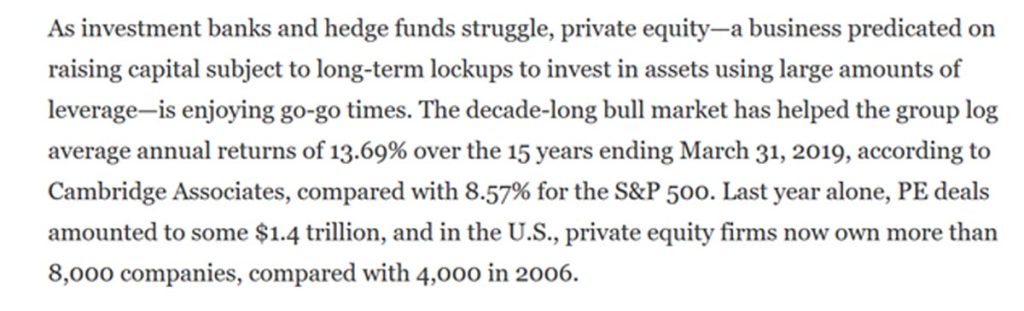

According to an October 24, 2019 article in Forbes:

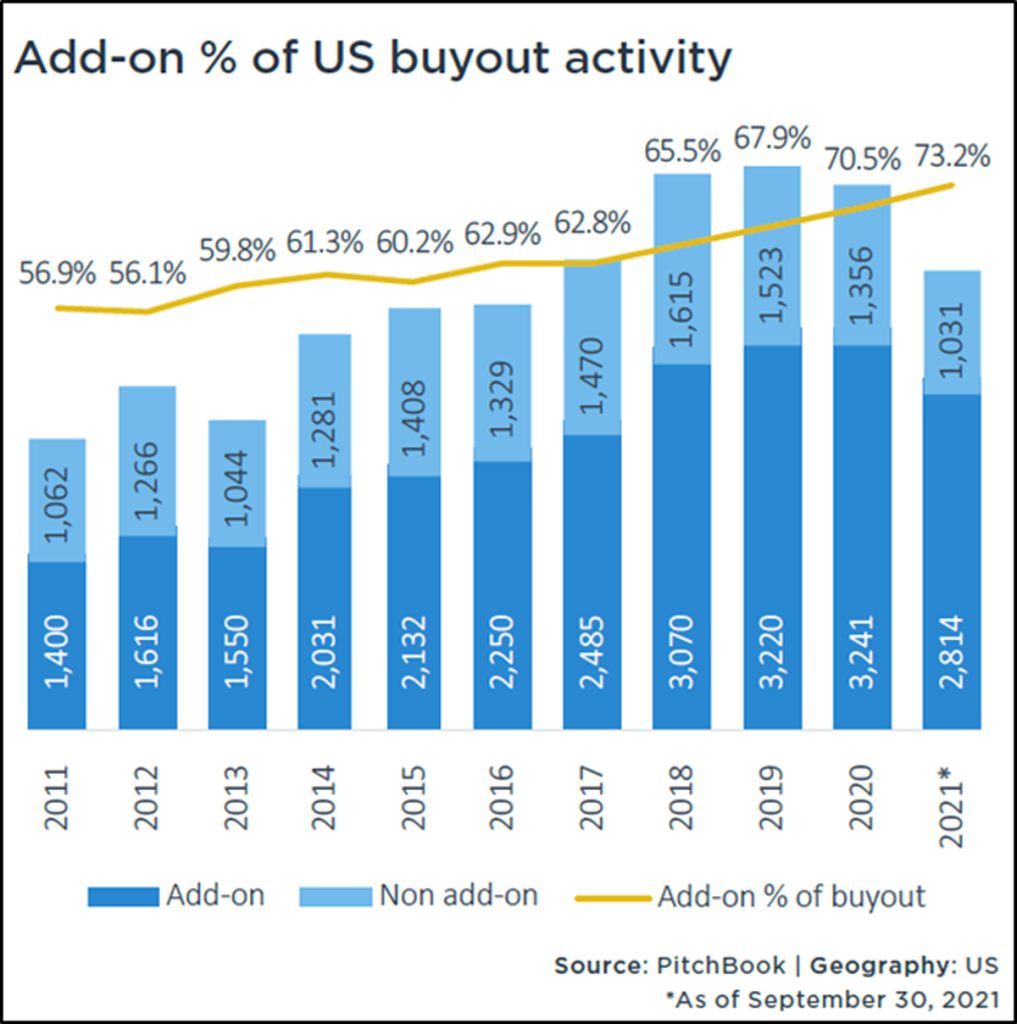

Private Equity strategy and how it’s changing your competitive landscape: While Private Equity firms bring a variety of strategies to bear when growing companies they own, one thing is clear: Many are using a “Platform plus add on” strategy to accelerate earnings growth faster than simply driving organic growth. In fact, two thirds of reported Private Equity deals reported in 2021 were “add ons”- in which a Privately backed business functions similarly to a ‘Strategic Buyer’ in acquiring companies in adjacent or synergistic industries. As a result of the prevalence of this, no Privately-owned company is too small to be a target for Private Equity – you’re either a ‘Platform’ for them or an ‘add on’.

Bottom line Impact on your Competitive Landscape: Given the staggering amount of Private Capital seeking to be deployed, and as an increasing number of Baby boomers begin to exit their companies, I are encouraging privately held CEO’s to consider this question: How does my business succeed in three years if my competitors have become “add on acquisitions” and are backed by Private Capital, but I’m not?

Family business transitions and Private Capital: I find that many business owners I meet with assume that engaging with Private Capital is a ‘binary proposal’ – i.e., you either “sell all of my company, or sell none of it”. However, in fact, a large number of transactions today happen either with the Founder retaining equity in the business or the next generation Family or Management Team doing so. In the current market, Founders are often able to sell 40%, 60% or up to 90%, depending on circumstances. Given this, many business owners find Private Capital as a means to exit the company with a significant liquidity event, rather than having to carry a large “seller note”.

If you are experiencing the impact of Private Capital on your industry, or would just like to learn more about any of the above, please contact me here.